What trustee type to use from SMSF is an important question and one of the first you will need to consider. There are two types of structures available:

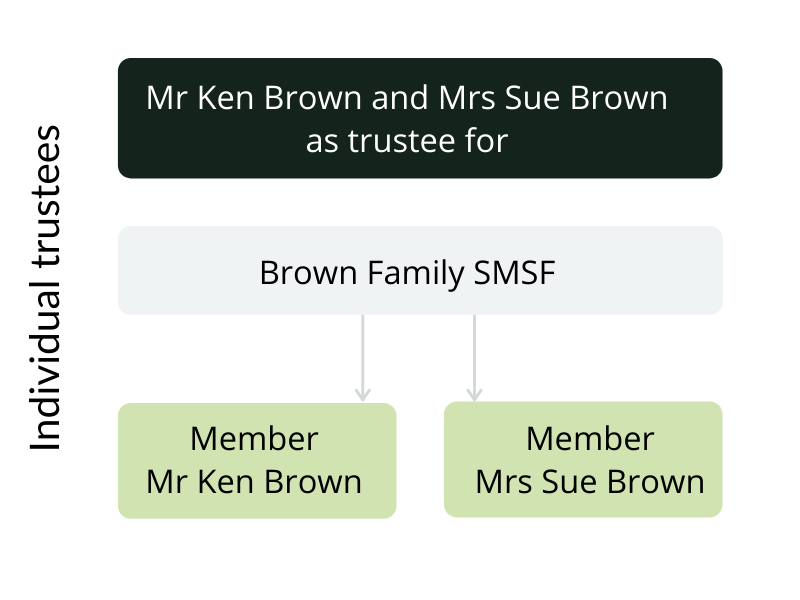

- Individual Trustees – Where the members of the fund act as the fund Trustees

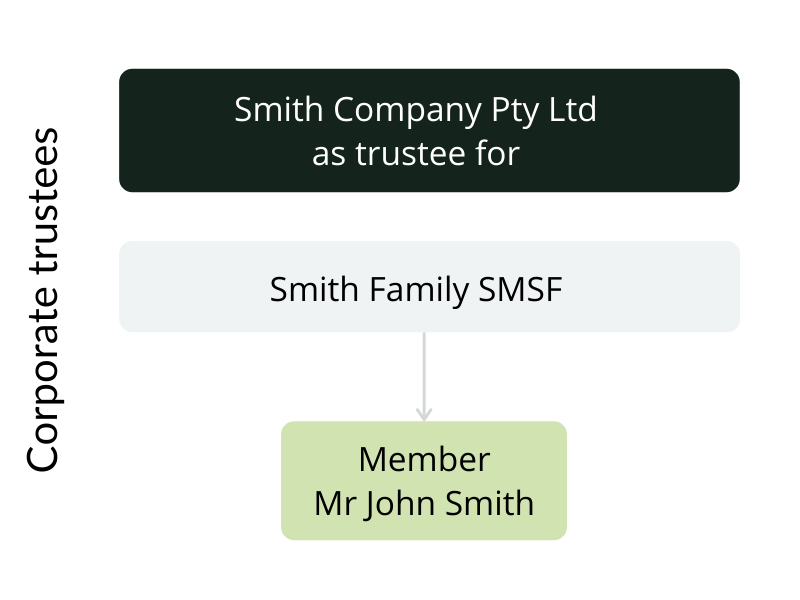

- Corporate Trustee – Where the members of the fund appoint a company to act as Trustee – and those members are Directors of the

Individual Trustees

Where you choose individuals to act as the trustees then your self managed super fund must have:

- Less than Five members

- Each of those members must be able to act as a trustee

- Unless related, no member may be employed by the other member

- Trustees cannot be paid for their role as trustee of the

What about a Single-member funds and individual trustees?

You can set up a fund with only one member. But you are still required to have two individual trustees. The member of the fund must be one trustee and the other can be a relative of the member or any other person who does not employ them. The second trustee does not need to have a balance in the super fund and has the same rights and responsibilities as the trustee who is a member of the fund.

You should carefully consider when appointing a second person to act as trustee for your single-member super fund. The role entails legal rights and responsibilities in relation to the SMSF, the same as the trustee who does have money in the fund so the position is not to be taken lightly. They may also have significant control over your super fund monies in the event of death. The alternative is to set up a corporate trustee and be a sole director and secretary, and this may be the best option for a single member fund for many SMSF members.

Corporate Trustees

Where you choose to incorporate a company to act as trustee for your SMSF you should consider the following:

- Fund is to have less than 5 members

- Each member must be a director of the company

- No member is an employee of another member, unless related

- The corporate trustee or the directors of

the corporate trustee cannot be remunerated for their service as trustees.

Single-member funds and a corporate trustee

A sole member SMSF can set up a company to act as the trustee of their super fund of which they can be sole director and shareholder. In this case, they do not require an additional person to act as is the case for individual trustees. So it avoids the risk of involving a second person if you are the sole member of your super fund.

Please note we recommend the incorporation of a special purpose company to act as trustee rather than using an existing company to act as the trustee of your super fund – unless it is available to act solely as the corporate trustee and the constitution can be updated to a special purposes company and is not used in any other capacity.

At SMSFlive we agree with what is widely accepted by the ATO, and professionals in the industry, that a company trustee structure is the preferred option. So we always recommend the use of a Special Purpose SMSF trustee company.

There is a fee to incorporate a company and the company will need to be administered by an ASIC Agent, and pay an annual fee to ASIC. However, a special purpose corporate trustee pays a reduced annual fee to ASIC as opposed to an ordinary company and more closely aligns with superannuation rules in section 17A of the SIS Act 1993.

While using individuals as trustees of the fund does reduce the annual running costs you should consider the potential issues or cost down the track of who controls the fund in the event of death/incapacity. There are clear benefits of a special purpose company trustee.

Changes in member’s circumstances can be a concern

Where you have Individual trustee fund’s then it is likely to be a change in members circumstances at some time and when this occurs you will need to change the name the assets are held in as a result. You will need to change the name of all of the assets held by the fund if this occurs.

The fund’s assets must be held in the individual trustee’s names – so when there is a change to the structure due to death, divorce, disablement etc. – then there’s going to be significant time and money involved to change the trustee structure and changing the trustee names on all the investments.

This is even more difficult where an SMSF holds property in the fund.

A key benefit of an SMSF special purpose corporate trustee is you can add or remove members without having to worry about the names on the underlying assets.

Reduced risk of litigation and separation of assets

The Individuals acting in the trustee role can be jointly and severally liable for any action taken again against the fund as the assets are held in their individual names. So where there is any litigation taken against the fund and where it were to exceed the assets held in the name of the trustees, the personal assets of the individual could be at risk.

Companies, on the other hand, have limited liability and so any action taken against the corporate trustee is restricted to the assets held in the name of the company.

SMSF Borrowing Arrangements

If you are considering an SMSF Borrowing arrangement then it is a common requirement by SMSF lenders that a corporate trustee structure is in place for the SMSF Trustee before they will consider lending.

SMSF administration penalties

If the superannuation ATO SIS Act laws are breached, SMSF administrative penalties are levied on the SMSF trustee.

This penalty cannot be paid or reimbursed by the super fund.

Where you have an Individual trustee structure, then the penalty is imposed on each individual trustee – which could be up to 4 penalties. With a corporate trustee, only one penalty can be issued.

ASIC reporting obligations

SuperGuardian can act as the ASIC agent for your company and facilitate the preparation of the annual ASIC return. We maintain responsibility for ensuring all company compliance obligations are being met.

In conclusion

The investment in the incorporation of a company trustee of an SMSF at time of set up can save you time and money in the future. Why take the risk for the short term saving you might experience.

This is why at SMSF Live we recommend the incorporation of a corporate trustee for you SMSF from the start. A special-purpose corporate trustee structure is the preferred structure for an SMSF.

For further information on please call SMSF Live anytime on 1800 SMSFLIVE.

The advice provided is general in nature and is not personal financial product advice. The advice provided has been prepared without taking into account your objectives, financial situation or needs and because of this you should, before acting on it, consider the appropriateness of it having regard to your objectives, financial situation and needs.

Comments

0 comments

Please sign in to leave a comment.